Investor Funding Solutions

Streamlined transactional funding of Double Closings, Earnest Money Deposits, and Seller Carrybacks for real estate investors. Our large network and efficient systems ensure fast and easy funding. Focus on your deals, let us handle the closing funds.

📆 SCHEDULE A CALl

Are you a wholesaler or investor needing quick capital? Let's get your deals funded!

So What's It Cost?

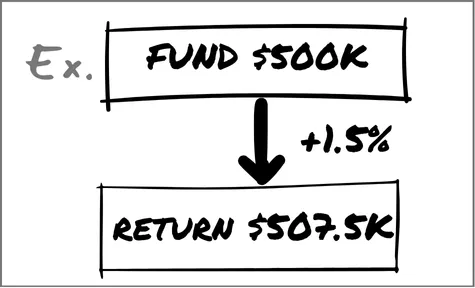

Double Closing

We fund Double Closings up to $100M. Rates range from 1.5% to 3%. 1.5% up to $1 million. 2.5% up to $5 million. 3% above $5 million. Less than one week's notice adds 1%. A $1,500 minimum return applies.

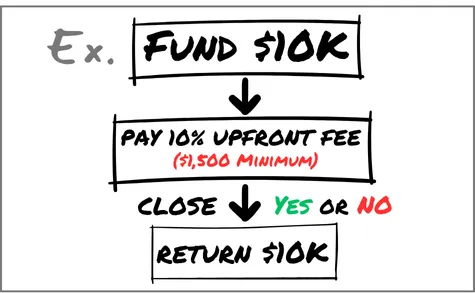

Earnest Money

We fund EMDs from $500 to $100,000 for wholesalers and end buyers. Funding lasts 30 days, with a maximum of 60 days (extension requires a new fee). Fee: 10% up-front & non-refundable per 30 days Minimum Return: $1,500. All fees collected up-front before funding.

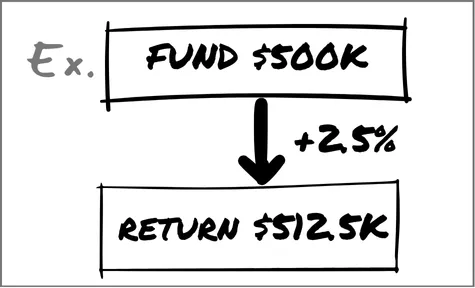

Seller Carryback

We fund Seller Carrybacks up to $1M. Rates are 2.5% for same-day closings. More complex transactions may incur higher fees. A $1,500 minimum return applies.

244

Deals Funded

$22.4M

Funded

132

Happy Borrowers

Frequently Asked Questions

What are your EMD Terms and Requirements?

We provide EMD funding from $500 to $100,000 for both Buyers and Wholesalers. The standard timeline is 30 days, with a 60-day maximum with an extension. An upfront fee of $500 or 1% (whichever is greater) covers underwriting and processing. This fee is deducted from our profit upon successful closing. We offer a 40% return for 30 days or less; the return increases beyond 30 days. We require a minimum return of $1,500 on all transactions. To secure funding, we require:

• Payment of the upfront fee;

• a mutual release signed by the seller and buyer;

• a signed EMD loan agreement.;

• and a disbursement agreement from the title company.

If you are a Buyer you will also need to provide: 3 HUDs demonstrating prior experience.

How much do you charge?

All deals have a $1,500 minimum return.

EMD funding rate is charged at a 40% return. We can fund $500 to $100,000 for both Buyers and Wholesalers.

Double Closings rates range from 1.5% to 3%. The rate depends on the transaction size. 1.5% applies up to $1 million. 2.5% applies up to $5 million. 3% applies above $5 million. Less than one week's notice adds 1%. We can fund up to $100M.

Seller Carrybacks are 2.5% for same-day closings. More complex transactions may incur higher fees. We can fund up to $1M.

Are there any upfront fees?

An upfront fee applies to EMD funding. This fee covers underwriting and processing. It is $500 or 1% of the EMD, whichever is greater. This fee is deducted from our profit at closing. We require this to protect against losses from cancelled deals. Therefore, you won't pay this fee separately if your deal closes; it's taken from our earnings.

What happens if the deal doesn't close?

In the event your EMD deal does not close, your sole expense will be the upfront fee. The 40% return fee is waived. However, the upfront fee reflects the opportunity cost of our funds being committed to your transaction, as well as the work our team invested in the underwriting and processing.

What qualifies as double closing?

A double closing is two real estate sales on the same day. It involves an original seller, an investor, and a final buyer. The investor buys from the seller (A-B). Immediately after, they sell to the buyer (B-C). Both transactions occur at the same title company. Investors profit by connecting sellers and buyers. They often use transactional funding for the initial purchase. This funding is repaid from the second sale, with a fee added. Double closings are legal and avoid issues with assignment fees. They are useful for hedge fund buyers and in jurisdictions where assignments are limited or illegal. They can also increase appraisal values for fix-n-flip investors, as both purchase prices are recorded.

What qualifies as a seller carryback?

A seller carryback deal involves a hard money or DSCR loan being used to purchase a property. The remaining amount needed for purchase is funded by the seller via a seller carry-back. This amount is typically equal to the down-payment and closing costs.

If you have a deal like this, the lender will likely require you to bring the down-payment to close and then be reimbursed by the seller carry-back. If the lender approves, we can fund that down-payment for you to close the deal.

Is there a max amount you can fund for each?

EMD funding from $500 to $100,000 for both Buyers and Wholesalers. Timeline: 30 days, 60 days maximum with an extension and fee added.

Double Closings we can fund up to $100M. Timeline: Same day closing.

Seller Carrybacks we can fund up to $1M. Timeline: Same day closing. Extra charges will apply for early Proof of Funds in account & extra actions needed.

How quickly can we get our deal funded?

We typically require 72 hours of notice to fund a deal, however we have funded in as quickly as 5 minutes (seriously). If you have a deal, your best bet is to submit it as soon as possible so we can review it and get the process started.

Copyrights 2026 | EMD DC